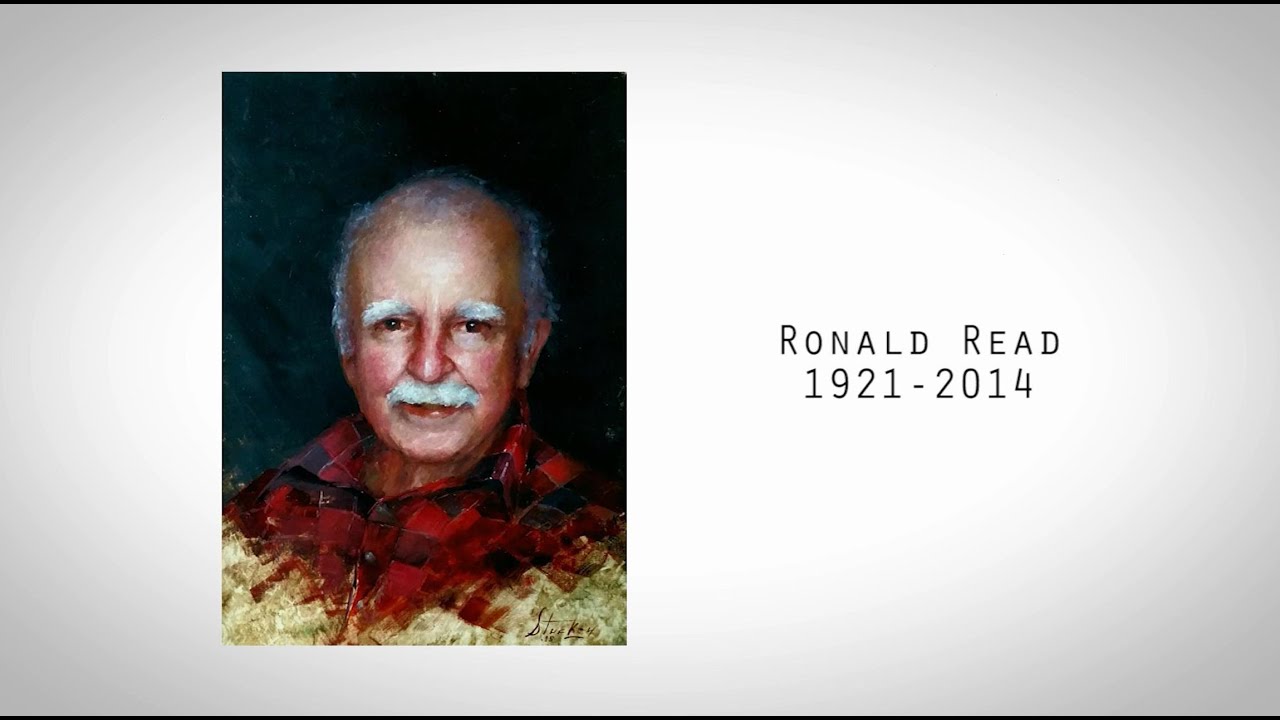

The story of Ronald Read is a showcase of how frugality, hard work and patience in investing can lead to highly rewarding results. Legendary investor Charlie Munger has always promoted trying to focus on such virtues as key to success in life but Ronald Read didn’t need to try: for him, adhering to such values was his way of life.

Read was born on October 23, 1921 into an indigent family that managed a farm. He was raised in Dummerston, Vermont, in a very small house and to go to high school, he had to walk 4 miles a day. Read graduated from Brattleboro Union High School in 1940, the first high school graduate in his family.

During World War II, he enlisted in the United States Army and was deployed to North Africa, Italy, and the Pacific Ocean theater. Before Christmas 1945, he finished his deployment and returned to Vermont.

He worked for almost a quarter of a century as an attendant and mechanic at Haviland’s Service Station, a gas station that he and his older brother, Fred, later purchased and then sold upon retiring. Shortly after retiring in 1979, he started working part-time at J. C. Penney where he did custodial, janitorial, and maintenance work before retiring, for a second time, in 1997.

Ron bought many shares of The J.M. Smucker Company, CVS Health, and Johnson & Johnson when he was relatively young and held them for a very long time. Many of the stocks he purchased were blue chip companies such as Procter & Gamble, JPMorgan Chase, General Electric, and Dow Chemical Company. He focused on companies that paid generous dividends, which he would reinvest into purchasing additional stock.

Read only invested in businesses that he could understand: He did not invest in technology companies and stayed away from the stock du jour.

When he died, he had no fewer than 95 stocks that were diversified in many industries such as healthcare, telecommunications, public utilities, rail transport, banks, and consumer goods. Although he owned shares of Lehman Brothers when it went bankrupt in 2008, the bankruptcy minimally affected his returns because his investments were diversified.

Read kept his stock certificates in a safe deposit box at his bank, which when piled together, reached five inches high. To remain updated on his investments, he relied on The Wall Street Journal, Barron’s, company filings and the public library near him. Read read The Wall Street Journal daily.

Read only invested in businesses that he could understand: He did not invest in technology companies and stayed away from the stock du jour.

His neighbors, family, and friends did not know the scale of the money he had amassed. Read used a safety pin on his fraying khaki denim jacket so he could continue wearing it and put on shabby flannel shirts. He was a regular at a local cafe where one time a patron paid for his meal because the patron thought Read could not afford the meal.

Later in life he owned a used 2007 Toyota Yaris, which Read’s lawyer, Laurie Rowell, said despite his being a millionaire, whenever he visited, he parked in the further parking spaces that did not have parking meters.

The Wall Street Journal said this about him, “Besides being a good stock picker, he displayed remarkable frugality and patience—which gave him many years of compounded growth.”

Read was a regular customer at Brattleboro Memorial Hospital’s Coffee Shop for many years. He especially enjoyed his daily breakfast, which included a cup of coffee and an English muffin with peanut butter.

He was a quiet man who chose to live a simple lifestyle despite the fact that he had made millions investing in the stock market – a passion of his. Ron believed in the hospital and all it offers the community.

After his death at 92, most of his $8 million fortune was donated based on his will: He donated $4.8 million to Brattleboro Memorial Hospital and $1.2 million to Brooks Memorial Library, which at the time had a $600,000 budget and a $600,000 endowment and was affected by the local budget squeeze like other libraries in the state. Both bequests were the largest donations the institutions had received.

We were really touched by Ronald Read’s story: he lived a simple yet happy life, followed his passion and showed patience. At the end, the lives of people in his community were also better because of him and his legacy.

Ron’s inspiring life proved to all of us that wealth is not solely determined by income. It’s about making smart financial choices ad maximizing what we keep.